Product Market Fit Stages – Measuring and Achieving Success

Product-Market Fit is a key indicator of success that guarantees high levels of customer satisfaction and revenue growth. If you...

In order to make this a little more likely, however, they need a proper method to assess the viability of the investment at hand.

In this article, we will explore some of the most common and popular startup valuation methods and discuss the advantages and disadvantages of each. By the end, you should have a better understanding of how to value a startup and what factors to consider in the process.

In this article:

When considering businesses with no revenue, it’s important to take into account the following factors:

Startup valuation methods are used for estimating the worth of emerging business ventures. Understanding how they work is crucial for entrepreneurs, investors, and other stakeholders who need to make decisions about funding, acquisitions, or exits.

However, valuing a startup is not an easy task, as there are many uncertainties and assumptions involved. Moreover, there is no one-size-fits-all method for startup valuation, as different approaches may suit different situations and purposes.

Below you’ll find a comprehensive overview of 14 of those startup valuation methods that will help you choose an approach most suitable for your case.

When valuing your startup, it’s crucial to remember that there is no one-size-fits-all approach. To arrive at an accurate assessment of your startup’s value, use a range of methods and compare their results. However, keep in mind that valuation is at its core subjective, as the value of all things ultimately depends on what someone is willing to pay for them. CEO, ASPER BROTHERS Let's Talk

The first startup valuation methods to know about is the discounted cash flow method.

This valuation method is best suited for relatively established startups that have already started generating results and profits.

This is because the way the method works is by taking a look at the current profits earned by shareholders. Then, a reasonable prediction of the startup’s profits is made for the next year or a longer timeframe. From there, the investor evaluates whether their potential profits are greater than the cost of the investment they’d have to make.

In order to make your startup a success in the long term, you do, after all, need careful planning and provable results. And this is what this valuation method can prove a startup has.

The only downside of the method is the fact that it cannot be used for startups that are just starting out.

Interestingly enough, people dabbling in the stock market prefer the standard earnings multiple startup valuation method.

This is because the standard earnings multiple method is perfect for tracking the rise and fall of a startup’s stock, seeing as it’s based on the average multiple. The average multiple is generated through a fraction where the largest number, or the numerator, is larger than the bottom number, or the denominator. From there, it is possible to come up with the profits or, adversely, losses that a startup has generated so far.

However, this method has the same obvious flaw as the discounted cash flow method. Namely, it is impossible to properly use it on a startup that is not yet established, as generating the averages reliably requires a lot of data.

Speaking of a startup valuation methods which can be used on emerging startups, we have the Berkus method.

The Berkus method, named after venture capitalist Dave Berkus, who developed it in the 1990, is a valuation approach that evaluates a startup’s base quality, irrespective of its revenue stream. It assesses startups based on five categories.

Some sources list sales or product rollout among the above categories . However, it must be emphasized that the Berkus method is primarily focused on fundamental qualities of a startup, rather than on its revenue stream. Therefore, while sales data may be an important factor in evaluating a startup’s potential value, they are not the primary focus of the Berkus method.

This information, assessed as a whole, can give reasonable insight into whether the startup is viable. Of course, the Berkus method is hardly infallible. In fact, even with perfect scores in everything, a startup can falter for a variety of reasons. So, it’s best to use this method carefully, as it’s quite risky.

The risk summation method is actually not one you’d want to use on its own. In fact, it only really works if you can use one of the other startup valuation methods from our list first to get a relatively solid ‘worth’ of a startup worked out.

From there, you account for potential risks a startup might face and consider the vulnerabilities of the startup in question. If the startup has reasonable chances and qualities to overcome risk, then this adds to its value. On the other hand, if it is highly susceptible to risk, it has some of its value docked.

You can account for as many risks as possible and then gauge whether or not to invest in a startup based on how much of its ‘original value’ is left.

This is an alternative method for assessing the early days of startups to the Berkus method.

It’s based on the idea that investors expect to receive a certain return on their investment. The venture capital method involves estimating the startup’s potential future value and then determining the required rate of return for investors. This required rate of return is used to calculate the startup’s current valuation.

In essence, you want to account for:

For an investor, some points in the Berkus method, such as predicted profits at exit, can be uncertain. Even if an investor plans to pull out of their investment at the initial public offering, plans can change, and they might end up spending more money than planned. Therefore, the accuracy and effectiveness of this valuation method strongly depend on the investor’s planning and decision-making abilities.

For an investor looking at a relatively established startup and determining whether it’s a worthy investment based on its current value and stock, then there are few better options than the book value startup valuation method.

In essence, this method asks the question: if all the company’s assets were liquidated right now, what would the shareholders earn and walk away with? To come up with this number, the method takes into account the stockholder’s equity minus its preferred stock, and then those numbers are divided by the number of the company’s common shares. In short, you end up with the difference between the company’s total assets value and its liabilities.

The book value method completely disregards the startup’s current opportunities and its potential future, which is not ideal for people who intend to do more than temporarily hang onto stocks.

The thing about startups is that it’s often hard to accurately predict their future. In no small part, this comes down to the fact that it’s possible to mess up business growth and expansion.

The cost-to-duplicate method seeks to assess this risk of failure. It does so by taking into account all expenses and costs borne by the startup so far, including money spent on product development, marketing, and similar. Then, it calculates the effectiveness of the startup using investment by comparing the expenses to generated profit.

The faults of this system are obvious: it focuses purely on the output and doesn’t account for future product viability, the quality and value of the startup’s leadership, or any potential changes to the demands of the market.

Still, it’s a solid valuation method if you want to know if the startup will properly use the money you invest!

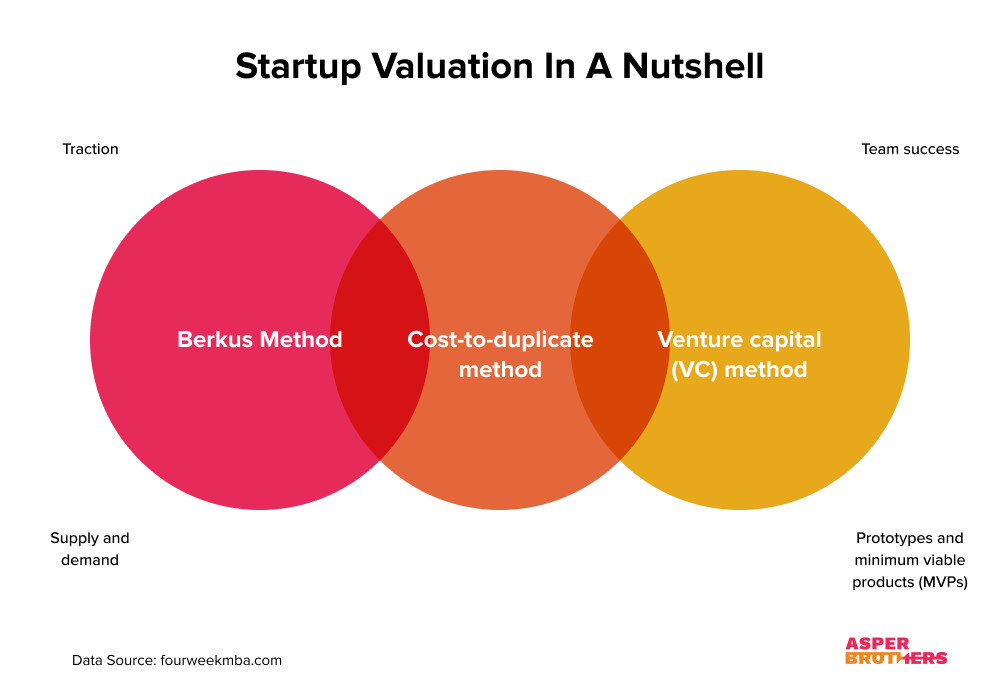

A comparison between the Berkus method, the venture capital method, and the cost-to-duplicate method that shares traits of the two.

This method looks at the startup’s market share and industry trends to determine its value.

It estimates the value of a business or asset by comparing it to similar businesses or assets that have been sold in the market in the past. It is based on the principle of supply and demand, and assumes that the market price reflects the fair value of the business or asset.

Based on the industry trends, the market approach helps determine the startup’s market share and assesses its potential growth, assuming that there is sufficient market data available.

This method is often used for startups that are in highly competitive industries. It is commonly used in real estate, M&A transactions, and business valuations.

This valuation method compares the startup being evaluated with other similar startups that were sold in the past.

The investor compares the financial and operational performance of the startup with the performance of similar startups that have already been sold. The comparable transactions method helps determine the market value of a startup by looking at the valuation multiples of similar companies.

The First Chicago Method is one of the most complex on our list simply because it merges the elements from three different methods. Them being the discounted cash flow, standard earnings multiple, and the risk factor summation methods.

This is because this method is typically used to assess “risky” startups with relatively uncertain prospects. Even if you’re doing great at the moment, your investors might doubt that you’ll be capable of managing a sales team or that you may require professional assistance to keep your team on the right track.

This method is similar to the discounted cash flow method, but it considers a startup’s risk factors more thoroughly. It involves discounting the startup’s future cash flows based on the risk factors associated with the startup, such as the startup’s industry, competition, management team, and market size.

Whatever the case may be, some startups require a lot more care and time to assess. This means that generating usable results may require putting a lot more effort compared to other, faster valuation methods. However, taking the time to conduct a thorough assessment can provide greater certainty that the investor is making the right investment decision, particularly for startups with more complex business models or unique value propositions.

This is an interesting valuation method since it actually places extreme importance on the team behind the startup.

The valuation method requires you to assign a worth to the startup’s team, then try to predict the percentage of obtainable market volume for the startup. In other words, you need to gauge how much of the market the startup can corner.

By combining the two factors, investors get a decent handle on the startup’s long-term potential. Of course, the method is not foolproof – it’s highly subjective and hinges on the assumption that the current team won’t run into any issues and disband. Still, it’s a refreshing option for assessing the long-term viability of startups from an angle that is not focused on profits.

The liquidation value method is used to determine the value of a company’s assets in the event of a forced sale or liquidation.

It is one of the more conservative valuation methods, as it assumes that the startup’s assets are being sold in a short period, typically in less than a year, and often at a lower price than their fair market value.

To calculate the liquidation value of a startup, all its assets are valued at their expected selling prices in an auction or a fire sale, and from that amount, all its liabilities are subtracted. The final result is the liquidation value of the company.

This method is particularly useful for companies that are struggling financially or are currently in bankruptcy, where the going concern value is less relevant.

This method determines the cost of completely rebuilding a startup. It involves estimating the cost of replacing it’s assets and operations with similar, presumably better, ones.

The replacement cost method assumes that the value of a startup is based on the cost of creating a similar business from scratch, rather than on its current revenue or future potential earnings.

To value a startup using this method, its tangible and intangible assets are identified, and their replacement cost is estimated. This includes equipment, property, patents, trademarks, and other assets. The cost of hiring and training employees, setting up infrastructure, and establishing the business’s operations is also factored into the calculation.

One advantage of the replacement cost method is that it provides clear and objective valuation based on tangible assets of the business. However, it may fail at accurately reflecting the startup’s potential for growth and profitability. Additionally, intangible assets, such as intellectual property and brand recognition, may be undervalued when using this method.

The replacement cost method is often used for startups that have unique assets or proprietary technology.

The final method among startup valuation methods is the scorecard method.

Now, this is another example of a method you should use during the earliest days of a startup. And it’s also the method to use for assessing startups in a highly competitive market.

Simply, the entire logic behind this method is to cross-reference the startup you are interested in with similar startups in the past by following the ‘scorecard’ you made up for it. By finding similar startups, you can then look at their valuations, successes, and risk factors associated with investing in that startup.

The scorecard is typically composed of the quality of its management team, its startup marketing strategy, market size, competitive environment, product/service, and financial projections. Each factor is given a score, and the scores are then weighted to determine the startup’s overall score.

Going through our guide on startup valuation methods, you probably noticed that they all have their flaws. There is no one-size-fits-all method for valuing a startup, but rather a range of approaches that can be used depending on the context and purpose of the valuation.

This is why it’s best not to rely on a single startup valuation method and to try and compare the results of several. After all, having an accurate assessment of your startup’s value is key when trying to secure funding. You want to make sure that the offer you get is both attractive and fair.

Lastly, it’s important to note that all the above methods have a degree of subjectivity to them. Ultimately, the value of a startup is determined by what someone is willing to pay for it, which may depend on factors beyond numbers and formulas.

Product-Market Fit is a key indicator of success that guarantees high levels of customer satisfaction and revenue growth. If you...

Startup funding rounds refer to the different stages of funding that a tech startup goes through as it grows and develops...

Venture capital is granted to new companies with considerable potential for success, especially in terms of their long-term growth. Starting...