Startup Bootstrapping – Self-Funding Advantages and Disadvantages

In today's world, funding new business initiatives, especially in the technology industry, has many forms. One method is self-funding...

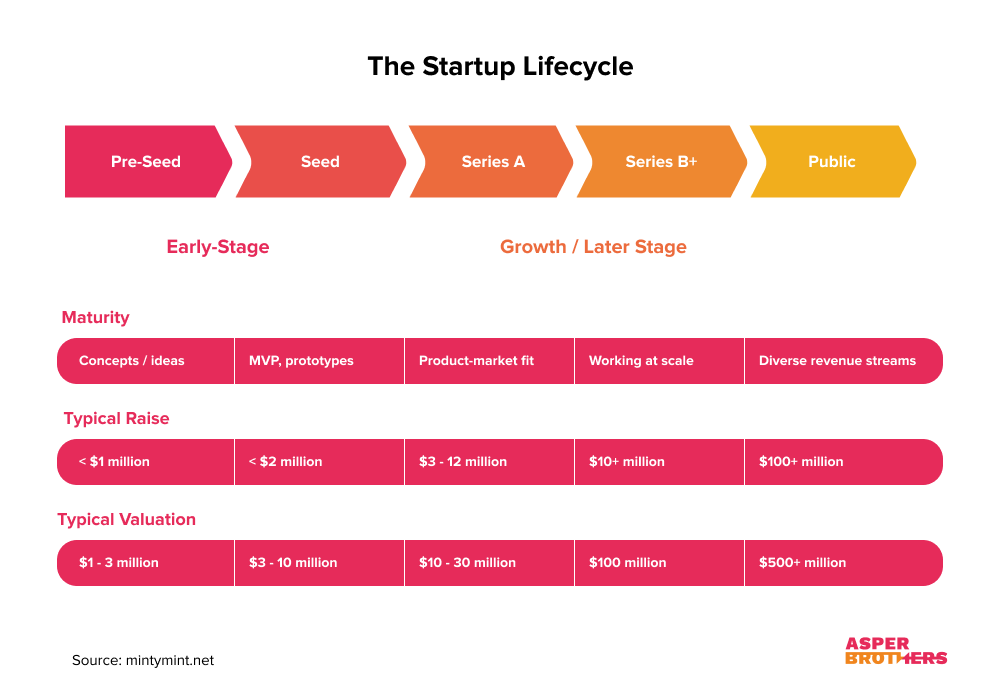

To help you make sense of it all, let’s take a closer look at the different types of tech startup funding.

Startup funding rounds refer to the different stages of funding that a tech startup goes through as it grows and develops. The most common types of tech funding rounds are seed funding, Series A, Series B, and Series C.

Seed funding is the initial round of funding that a tech startup receives and is typically provided by angel investors or other early-stage investors. This funding is used to help the startup develop its product and conduct initial market research.

Series A funding is the next round of funding that a tech startup receives, usually provided by venture capital firms. This funding is used to help the startup further develop its product, expand its operations, and build out its team.

Series B and Series C funding rounds are subsequent rounds of funding that a tech startup may receive and are typically used to help the company grow and expand. A combination of venture capital firms and strategic investors can provide these funding rounds.

According to Jim Pendergast, Senior Vice President of altLINE Sobanco, – The most important thing to consider when deciding which type of startup funding rounds are best for your company is the stage of growth and development you are at. Each type of funding has unique benefits and drawbacks, so it’s important to understand which type is best suited for your particular situation.

Pre-seed and seed-stage funding are two of the most common funding rounds for tech startups. Pre-seed stage funding is the initial round of funding that a startup receives to help it develop its product and conduct initial market research.

Seed stage funding is the next round of funding that a startup typically receives to help it further develop its product, expand its operations, and build its team.

Effective budget management is especially important at the beginning. That’s why creating an MVP turns out to be the best way to validate an idea before large resources are committed. The experience of our clients shows that a good MVP is a key to getting further rounds of funding for a startup. CEO, ASPER BROTHERS Let's Talk

There are several advantages to receiving pre-seed funding for your tech startup.

First, pre-seed financing can help you validate your idea and prove that there is a market for your product.

Second, pre-seed funding can help you build a prototype or minimum viable product (MVP), so you can start collecting user feedback.

Third, pre-seed funding can give you the resources you need to start marketing your product and generate early sales traction. Finally, pre-seed funding can also help you recruit key team members who will be essential to the success of your business.

There are also some disadvantages to consider before accepting pre-seed funding for your startup.

First, pre-seed funding may not always be enough to cover the expenses associated with launching a tech startup.

Second, pre-seed funding may not be available from traditional sources like venture capital firms, so you may have to look for alternative funding sources.

Finally, pre-seed funding can be risky as there is no guarantee that your tech startup will succeed.

The startup’s growth is a long road, in which funding rounds are closely linked to the stage and scale of success and potential.

Series A round funding is the next round of funding that a tech startup receives, usually provided by venture capital firms. This funding is used to help the startup further develop its product, expand its operations, and build out its team.

There are several advantages to accepting Series A funding for your tech startup.

First, Series A funding is usually more significant than pre-seed or seed-stage funding, giving you access to more resources for development and growth.

Second, Series A investors have typically experienced venture capitalists who can provide your startup with valuable guidance and mentorship.

Third, Series A funding can help you attract top talent and build out the infrastructure of your business.

Finally, Series A funding can also help you attract additional investors and raise even more money to grow your business.

There are also some disadvantages to consider before accepting Series A funding for your startup.

First, venture capitalists will usually require a significant amount of equity in your company, meaning you may lose some control over the direction of your business.

Second, venture capitalists typically want to see a return on their investment within a certain period, so you may need to focus on short-term growth at the expense of long-term sustainability.

Third, venture capitalists may also require you to make specific changes to your business to meet their expectations.

Catherine Schwartz, Finance Editor of Crediful, says – One of the great things about Series A funding is that it can give tech startups the resources they need to scale quickly. But, it’s important to understand all potential risks and rewards associated with accepting Series A funding.

Series B round funding is the next stage for tech startups, typically provided by venture capital firms or private equity firms. This funding is used to help the startup expand its operations, hire more staff, and develop new products.

While each situation is unique, a few general advantages come with this type of funding. For one thing, it can help to validate the business model. This is because Series B investors are typically more interested in growth potential than in generating quick profits.

As a result, their investment can be a vote of confidence in the long-term viability of the business. Additionally, Series B funding can help to accelerate growth. This is because the additional capital can be used to fuel marketing and expansion efforts.

Finally, Series B funding can also help attract top talent because it signals that the company is serious about its long-term success and is willing to invest in its employees. These advantages make Series B funding an attractive option for many tech startups.

As with any funding, there are also some potential drawbacks to consider before accepting Series B funding. First, the investor may expect a higher return than is typical for earlier funding stages. Your company will need to focus on generating profits to pay back the investor.

Second, venture capitalists may want a say in how the business is run, which could mean giving up some control over the company’s operations. Finally, venture capitalists may also want to bring in their own people or change the company’s strategy, which could disrupt your business’s culture.

According to Jarret Austin, Owner of Bankruptcy Canada Inc., – Series B funding is the most popular funding choice for tech startups, as it allows them to keep a reasonable amount of control over their business while also receiving a significant cash injection.

There is no one-size-fits-all answer when it comes to funding a tech startup. However, Series C funding is an option that is often used by companies that have already gone through the Seed and Series A/B rounds of funding. Series C funding is more expensive than earlier funding rounds, but it can also provide more capital for a company to grow.

One advantage of Series C funding is that it can help a company scale its operations. This type of funding can also provide a company with the resources it needs to hire additional staff and expand its product lineup. However, there are also some disadvantages to consider.

For example, Series C funding can put a lot of pressure on a company to achieve rapid growth. This type of funding can also be challenging to obtain if a company is not already established. Before deciding, weighing the pros and cons of all the available options is essential.

Launching an initial public offering (IPO) is often seen as a significant milestone for a tech startup. Going public can bring in a large influx of cash that can be used to fund new projects, expand into new markets, and hire new talent.

However, there are also several potential drawbacks to going public. For one thing, going public usually means giving up some control over the company. Founders and early investors may no longer have a majority stake in the business, and the company will be subject to greater scrutiny from shareholders and the general public.

In addition, IPOs can be expensive and time-consuming to execute, and there is always the risk that the stock price will fall flat after the IPO launch. As a result, it is essential for tech startups to carefully weigh the advantages and disadvantages of going public before making a final decision.

When it comes to tech startup funding rounds, startups have a lot of options. For early-stage companies, angel investors and venture capital firms are the most popular funding sources. Series B and C Rounds are typically used for growth, while an IPO is often the last step before a tech startup goes public.

Each type of funding has its advantages and disadvantages, so it’s essential to consider all the options before deciding. With careful planning and the right resources, tech startups can find the funding they need to succeed.

In today's world, funding new business initiatives, especially in the technology industry, has many forms. One method is self-funding...

The American start-up industry is going strong because of angel investor funding. Worried about the fact that your knowledge is...

We’ll explore everything startup founders need to know about due diligence, so you can head into your next funding round...