Benchmarking Analysis for a Tech Startup - Understand your Competition in 6 Steps

Benchmarking analysis consists of identifying weak spots in your business strategy, carefully observing the competition to see what they do differently...

But, before you head into the boardroom with your pitch, you’ll want to make sure you’ve dotted your I’s and crossed your T’s. By this, we mean you’ll want to prepare for the due diligence process.

Below, we’ll explore everything startup founders need to know about due diligence, so you can head into your next funding round full of well-earned confidence.

In the startup world, due diligence refers to the audit process a potential investor undertakes before committing to investing in your business.The aim of due diligence is to check that everything your company says matches up with the data.

Investors also use due diligence to uncover any red flags a startup may have left out of their investment pitch.

There’s no one hard and fast process for due diligence. The intensity of the activity often depends on the amount of investment involved. For example, a startup looking for pre-seed funding will likely go through a less rigorous analysis than a company heading into series A funding.

Sometimes, due diligence can be as simple as a face-to-face conversation at the end of your pitch. Other times, it can involve lawyers, accountants, and a load of paperwork. In these scenarios, investors may want to look at things like your financial numbers and even your personal history. It’s not uncommon for investors to run background checks on potential investee companies!

Due diligence tends to occur after you’ve presented to a venture capitalist firm or angel investor. If they’re interested in your proposition, the natural next step is for them to carry out due diligence on your company.

Think of it this way: you wouldn’t buy a property without first carrying out a survey to check for potential issues. Angel investors view the investment process in the same way. The due diligence process is how they gain assurance in your company. After all, these guys are in the business of making a profit! They want to make sure that your company stands to give them a great ROI.

Note, too, that it’s never wise to fudge the books and misrepresent your business. While all startups are keen to grow and gain investment, honesty and integrity are paramount. If you falsify any documents, your investor will eventually find out. When they do, you’ll suffer huge legal complications.

For one, many investors include specific terms in their contracts relating to misinterpretation. If you’re found to have misguided one of your stakeholders, they could sue you — and you could even be penalized under criminal law.

All of this is to say that due diligence is a process that should be taken seriously. Don’t try to pull the wool over your investors’ eyes. Approach the process with a commitment to accuracy and transparency, and you’ll be best off in the long run.

Our experience working with startups has shown that preparing for due diligence is a great opportunity to do an internal audit and get the formalities in order, as well as verify the growth plan. Preparing for due diligence allows you to once again get a bird’s eye view of the startup and see areas that are worth optimizing even before the investor enters the company. CEO, ASPER BROTHERS Let's Talk

Typically, investors will have a standardized checklist that they go through to verify that everything is as it should be. The checklist will be different depending on the firm; you’ll likely find that each investor asks for different things.

While this can make things complex, there is a way to make due diligence easier by preparing in advance all the most common documents that investors ask for. Essentially, you’ll want to complete your own due diligence checklist so everything is ready to go when a potential backer asks for it.

As a side note, we strongly recommend entering a confidentiality agreement with an investor or firm before handing over any documentation using a secure cloud storage system. This is because of the sensitive nature of the data you’ll disclose. You’ll want to ensure the party is obliged to keep this information confidential.

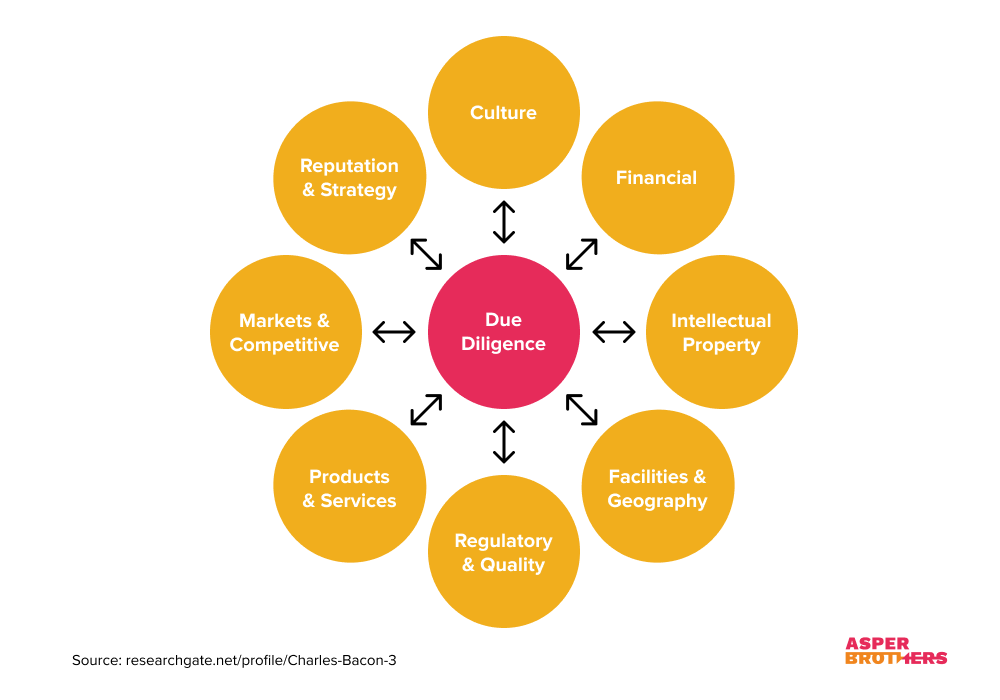

With that in mind, here are the eight things to prepare for your next due diligence assessment.

The scope of Due Diligence varies depending on the stage of development of the company and the purpose of the analysis. Often a specific area is analyzed.

Your business plan and financial records are the most common data points investors ask for from you. You’ll be expected to send information like your balance sheet, income data, cash flow overviews, your ledger and capitalization table, as well as, of course, your business plan.

For your potential backer, the aim of reviewing this information is to make sure that your pitch deck matches up with the concrete numbers. They’ll also want to ensure you’re not struggling with debt, as this can spell trouble and make your company a liability.

Your IP rights are a key economic differentiator, encompassing things like patent information, copyrights, design rights, trademarks, and so on. Each asset is extremely compelling to an investor as they improve your company’s corporate value. In the long term, after all, investors are hoping you’ll sell your organization for a lot of money. IP is integral to doing this.

Naturally, then, your investors will want to take a look at your IP rights. If you’re yet to have any in place, we strongly recommend filing for patents and trademarks before heading to a smart investment pitch. Otherwise, you probably won’t get the outcome you’re looking for.

Because startups often rely on external investments and have multiple co-founders, they tend to have complex structures. Before investing, any firm will want to see a document detailing your ownership structure. Make sure this is up-to-date.

In addition to producing a document of your legal structure, you’ll also want to have your certificate of incorporation and certification of designation to hand. We also recommend filing minutes of stakeholder and leadership meetings, as angel investors are likely to request these too,

The startup world can be pretty tough. If your company is in the unfortunate position of battling a lawsuit, ensure to be transparent with any investors. Provide documentation on any legal issues, pending or threatened.

The human factor is a huge part of the investment process. As part of due diligence, you and your colleagues are probably going to be put under the microscope. As well as conducting background checks, potential investors may wish to speak with you and your team one-on-one to get an idea of your personalities, values, and skills.

There’s not as much you can do to prepare for this phase. It’s ultimately about being the best version of yourself and communicating yourself as well as possible under pressure.

Even if all the data checks out, your investors ultimately choose to invest in you and your people. The success of your company depends on your team, so it makes sense that investors place such an emphasis on the people element of a startup.

In your pitch, you’re going to say that you’ve developed a product or solution that customers love. Potential backers will want to check this. They may ask to reach out to customers for verified feedback about your company.

However, customers aren’t the only third-party investors they are interested in. They’ll also want to know about your supply chain. It will be crucial for them to gain an understanding of the vendors and suppliers you work with. They may contact your partners in these organizations to gain an understanding of your working relationship and ensure that everything is as you’ve documented it is.

Investing is a numbers game, so expect venture capitalist firms and angel investors to want to gain a deep understanding of your revenue streams. Ultimately, they want to figure out how your company makes money and how you’ll make even more money in the future.

This step will include preparing metrics such as:

Now, it may be that your business isn’t yet in the money-making phase. If you’re currently only at proof-of-concept, don’t fear. Focus on the potential of your product or solution, creating realistic forecasts of what your revenue will look like once your company takes to the market.

Be wary of being overzealous about proposed figures; investors are typically experts within their respective markets. If you’re too bold and extreme with your predictions, this may put them off.

If you’ve proposed that your product is industry-first, with game-changing features that are like nothing else out there, you best make sure this is accurate. As part of the due diligence process, angel investors will undertake an intense review of your competitors, the overall state of the market, and how you fit into it.

To prepare for this step, ensure you’ve undertaken a truly in-depth, current market analysis so you can come back to any questions a potential backer may have. Hopefully, you’ll already have a superb understanding of the space you’re in.

The most important thing, then, is to stay up-to-date with the latest trends in your industry. New startups are popping up every day, and the global market is pretty volatile right now. Staying on the pulse is, therefore, vital and will show your investors that you’re reliable and in-the-know.

Your startup could gather fantastic momentum and be ready to leap to the next level. However, if your data isn’t in good order, an investor may not build enough confidence to sign anything on the dotted line.

For that reason, preparation is key. By following the above checklist, you’ll be able to tackle the due diligence process and make yourself a dream prospect to potential investors.

While looking at the fine print and gathering data isn’t the most exciting, it’s worth it in the end. After all, we’re talking about millions of dollars here in many cases! Remember, too, that the investment market is extremely competitive.

There are thousands and thousands of startups out there, just like you, who are seeking funding. Often, the difference between investment success and failure is how companies approach due diligence.

Put in the time and effort to ensure that all your company’s documentation is accurate, transparent, and matches what you’ve put in your pitch desks. Do this, and your startup will be on the way to an exciting new phase.

Benchmarking analysis consists of identifying weak spots in your business strategy, carefully observing the competition to see what they do differently...

A break-even point (BEP) is an essential phase for a startup. It is the point at which the costs and...

The American start-up industry is going strong because of angel investor funding. Worried about the fact that your knowledge is...