Tech Startup Guide – How to Find Idea, Technology Partner and Funding?

Do you know why start-ups fail? Well, according to research by CBInsights, the most common reason for failure is ‘no...

The American start-up industry is going strong because of angel investor funding. Worried about the fact that your knowledge is too little about this subject? No worries.

This article has everything related to investment and angel investors for startup founders and businesses that you must know.

More than 64,000 startups got $25 billion in funding from 300,000 angel investors in 2020. It’s just what the US is experiencing with angel investors’ power. If we talk about the entire world, the grandeur of angel investors is magnificent.

All the big giants like Facebook, WhatsApp, Uber Airbnb, and many more have managed to rule over their respective domains because they all had the backing of angel investing. So, if you dream of bravura success for your startup then you must work on your skills to fetch angel investments.

By literal definition, angel investors are capitalists or financiers that provide funds to businesses of all sorts. In exchange for the investment, they seek a certain percentage of the company’s equity. Such sort of investment also known as convertible debt could range anywhere from $25,000 to $500,000 or even more when the startup grows faster.

Their role in a startup or a business is limited to providing funds or finance. They won’t have any right to take operational decisions or decide on company policies. Angel investors typically have backgrounds like corporate investors, venture capitalists, angel network associates, and business families.

Many angel investors – especially wealthy individuals – operate individually. However, it’s common to witness angel collaboration or investor groups when investment is huge.

As angel investors & venture capitalists offer capital to start the operations/product development at the very early stage of the business, they are often known as seed investors.

Startup fundraising via the angel investment approach could be of great help if you know it’s nitty-gritty. It’s a win-win situation for both the startup and the investor.

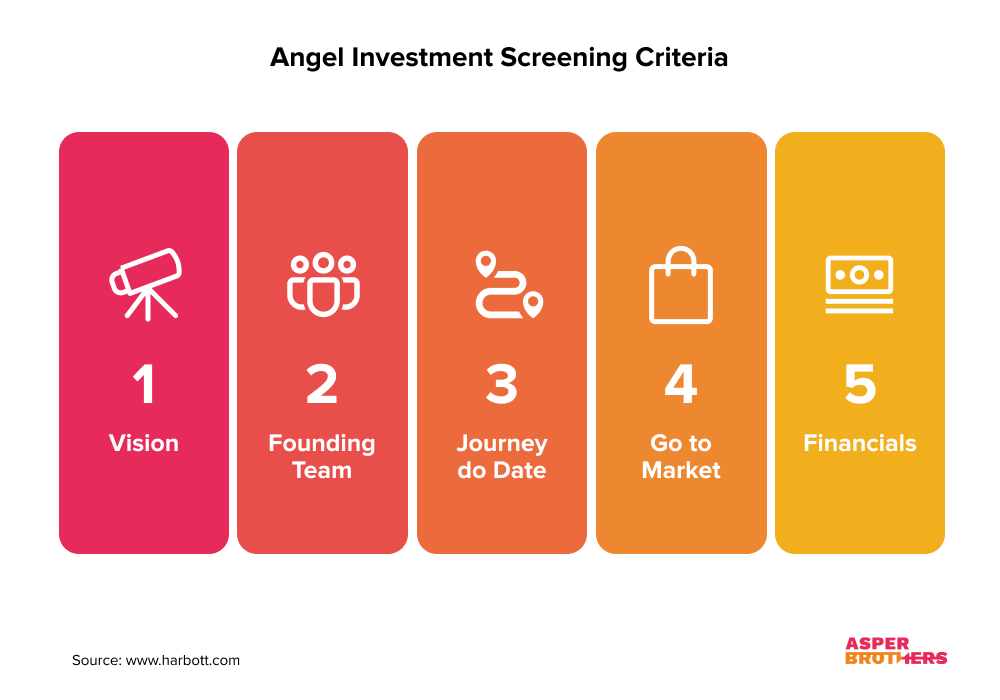

Each Angel Investor has slightly different final criteria when making a decision. For everyone, however, the key areas that represent potential are important.

Do you know Peter Thiel? If not then you must know him, as he was the first angel investor for Facebook. His $500K check helped Facebook to kick start the startup journey and the rest is history. His investment played a crucial role in the success of Facebook. In return, his $500K turned into $1 billion. Isn’t it great?

But, impressing potential investors isn’t easy. It demands tons of effort and a great presence of mind. It has become more tedious than before after the pandemic happened. As per Angel Capital Association, the investment dropped by 25% in Q1 2020. The situation got worse in Q2 2020. So, it’s not easy to fetch angel investment. But, it’s not impossible as well.

Here is what every tech startup should keep in mind while approaching the angel investor network:

Most angel investors will be able to understand what a startup is all about with the help of a business plan only. So, make sure you have a crisp business plan ready. Provide current and future projections for the business and your strategy to achieve the goal.

The most common rookie mistake that early-stage businesses make is to approach angel investors without knowing them well. You may look into their previous investments or startup capital funding-related projects to know about their interest and financial capability.

Also, it’s very important that the angel investor can connect with your idea/product. You need to research them well and pay attention to their past investments. There is no point to approach an angel investor who is interested in well-being or lifestyle products while you’re offering business software.

Don’t pitch investors without researching them first. They may not even invest in your industry, your geography, or your stage of growth, says Alicia Syrett, founder, and CEO of Pantegrion Capital.

For a startup, the team plays a crucial role. The potential angel investors typically wish (a lot) to know the brains behind the product/service. It’s a well–known fact that great products are made by a great team. So, make sure you have the right people in your team and you’re presenting them in the right manner.

Having a great team isn’t enough. Your idea or product should have some standing as well. Try to find out the difference-maker in your idea/product and present that to the angel investors. Present data that prove the excellence your idea/product bears. Eventually, the product/idea will bring success and revenue. So, the investors would be eager to find out the exceptional qualities that your idea has.

Over time, I’ve come to prefer a company that has a product that’s working, versus one that has a “good team” but a product that isn’t quite working yet. I’ve found that a “good enough” team, with support and guidance, often can pull off something great., says Andrew Chen, an angel investor in AngelList, Secret, and BarkBox.

Angel investors invest where there is a hope of high growth. They don’t want to invest in a business that gets stopped after reaching one point. They need a product that grows continuously and can pivot with time and as per industry requirements. So, make sure that your pitch includes your plan and prospects as well.

In addition to these, accredited angel investors want to learn about liquidity potential, ROI, the barrier to entry, and justified company stake against their investment too.

Start by saying what the market is: what’s the problem, what’s the solution. Objective validation is also important. This can take many forms. It could be actual sales, an award, or successful beta testing. Avoid presentation flaws., says David Rose, an NYC-based angel investor.

We will give you 4 simple tips for gathering venture capital funds successfully.

Don’t talk about yourself through the pitch decks. Talk about the product and start with storytelling. Try to present the difference your idea will make and how it will achieve the goal.

Add an attention grabber that will sum up tons of things about your product, venture research, and strategy for the future. Be to the point and quick.

Involve investors in the presentation. Add details about them or make them a part of the real-time presentation. If your product is ready, give angels a feel of it.

Talk sense and have a realistic projection of company valuation. Don’t brag about things and keep realistic goals. Mention the revenue projection that seems realistic and add a business plan/strategy to accomplish it.

Angel Investor is not just about finance. Often, financing is just a component of a larger picture that allows you to grow your business faster and more efficiently.

Depending upon the interest and expertise, angel investors can bring a lot to the table for a start-up. For instance:

They will help you have a great business connection using their past expertise. For early-stage startups, domain-specific excellence can play a great role in future success.

They can guide a startup on important fronts like team building, marketing, and so if they have worked in the industry before.

Joining hands with established angel investors helps a startup gain the popularity and attention of other investors. When a brand gets attacked by a startup, the market worth increases instantly. It works like direct and effective publicity.

Possibilities for future expansion and growth opens-up instantly as an expert or established angel investors will guide startups to find new opportunities.

Angel investor networks are growing with each passing day and there is no dearth of potential angel investors. You can find angel investors for your tech startup with the help of the below-mentioned ways.

Tons of online angel communities and platforms will help you connect with a wide range of angel investors for a startup. For instance, you can try AngelList. The platform connects angel investors across the globe and of various interests together. It’s one of the easiest and sure-shot ways to connect with dependable angel investors for tech startups.

You can also join Angel Investment Network to unblock an impressive database of trustworthy and legit angel investors. Gust deserves your attention because of the quick investment process. It will help you get funding without much roaming.

There are a couple of well-established investment companies that help people to get funds at an early stage of business. You can connect with them to find a suitable investor for your tech start-up. Our best bets are Tech Coast Angels and Golden Seeds are both famous for providing substantial funding to tech startups.

You can’t ignore the power of social media in today’s era. Businesses are getting everything from it; exposure, revenue, customers, and even financial backing. Facebook is running a small business grant program. Give it a shot. Startup Funders is a community on Twitter that is connecting startups and angel investors.

At times, you can get early-stage investments from your friends and family as well. They won’t be polished or professional angel investors but could be a great help when you need quick investments without risking much of the company stake.

The startup journey will only begin when you have the funds to fuel the idea. This is why getting risk-free funding is one of many most important things that startups have to be aware of. For founders, angel investment is a great relief.

The process of accumulating funds is far easier this way. However, you have to play and keep all your senses awake while hunting down an angel investor. It may seem tedious to vet target angel investors but you have to put in asked efforts. Once you manage to get the required and easy funding, no one can stop your business from touching the sky.

Operating in the technology startup market, together with our partners we provide opportunities for additional financing for young companies at different stages of development. If you are looking for support for your product, let us know. We’d be happy to talk about your vision. COO, ASPER BROTHERS Let's Talk

Do you know why start-ups fail? Well, according to research by CBInsights, the most common reason for failure is ‘no...

It takes a lot to bring a business idea to life and conducting sufficient and comprehensive market research beforehand is one...

A Minimum Viable Product (MVP) is a concept that originated in the startup world and is now used by companies of...