How to Find Angel Investor for Startup and Prepare Business Presentation?

The American start-up industry is going strong because of angel investor funding. Worried about the fact that your knowledge is...

In order to make informed decisions about financing, entrepreneurs and investors alike must understand both the mechanics of these funding models as well as the key differences between them.

For entrepreneurs, choosing the right type of funding can make or break their business. Investors, on the other hand, need to identify the right investment opportunity in order to maximize returns. With the rise of technology startups and increasing interest in innovative business models, it is essential to know which type of funding is best suited for these ventures.

This article will not only differentiate between Venture capital and Private equity financing but also attempt to dive deeper into the benefits and drawbacks of each. By providing real-world examples, we’ll help you acquire a more comprehensive understanding of the subject matter. By the end of this article, you will be able to distinguish between the two funding models and determine which one aligns with your business goals the best.

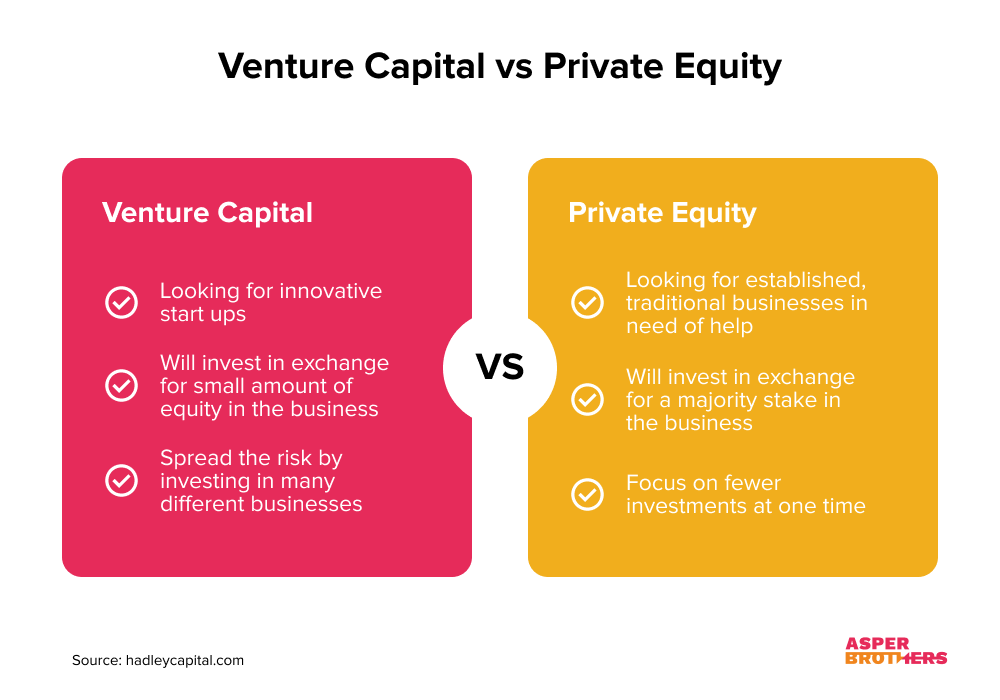

A comparison between venture capital and private equity.

Private equity is a complex and multifaceted investment strategy that requires extensive research and due diligence. Private equity firms often work with investment banks, lawyers, and accountants to conduct comprehensive analyses of potential investment targets. These analyses may include financial performance, market trends, management and employee skill sets, and potential growth opportunities.

Once a potential investment is identified, Private equity firms typically negotiate their terms of the deal, including purchasing price, the amount of control the investor will have over the company, and expected return on investment. Private equity firms also typically provide additional resources to the companies they invest in, including strategic guidance, operational expertise, and access to capital markets.

Private equity investments can be double-edged swords. Although they often provide investors with high returns, there’s also considerable amount of risk involved.

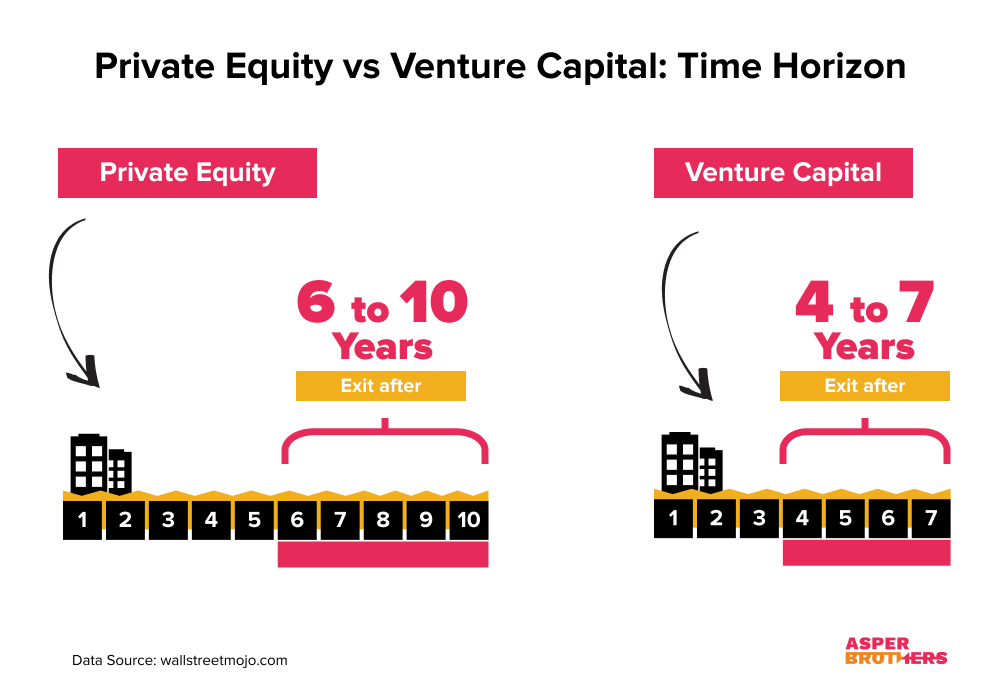

Private equity firms generally seek to exit their investments within three to seven years, either by selling the company or taking it public through an initial public offering; in many cases, they use a combination of these strategies to maximize their returns. However, high levels of debt and leverage often used by Private equity firms to finance their investments can also expose them to significant risks, particularly during economic downturns or other periods of financial instability.

Despite the risk, Private equity remains an attractive investment option for many investors seeking high returns and diversification. Private equity can expose investors to a wide range of industries and sectors, including technology, healthcare, energy, and consumer goods. Moreover, Private equity can provide them with access to unique investment opportunities that are not available through traditional investments such as stocks and bonds. However, due to its complex nature, Private equity is generally considered a suitable investment option only for the most sophisticated and experienced investors.

Venture capital investors often provide not only funding but also strategic guidance, mentorship, and access to valuable business networks. They work closely with management teams of their portfolio companies to help them develop and execute business plans, attract top talent, and navigate complex regulatory environments. This hands-on approach can be particularly valuable for early-stage companies that may lack either the experience or the resources needed to achieve their growth objectives independently.

One of the key advantages of Venture capital is its ability to provide financing for innovative and disruptive business models that may be overlooked by traditional sources of funding.

Venture capital investors are often willing to take on higher levels of risk than other investors in exchange for the potential of higher returns. As a result, Venture capital has played a significant role in the development of new technologies and business models in industries such as biotechnology, software, and e-commerce.

While Venture capital can be an attractive source of funding for small businesses and startups, such as a custom T-shirt design company, it is not without its risks. Venture capital investors typically require significant ownership stakes in companies they invest in and may also demand to have their say in major strategic decisions. Additionally, high levels of risk and uncertainty associated with early-stage companies can result in high failure rate for Venture capital investments. Despite these challenges, however, Venture capital remains a critical source of funding for many innovative and high-growth companies and its importance in the broader economy is likely to continue to grow in the coming years.

Private equity firms often employ a different investment strategy than Venture capital firms. Private equity firms typically look for companies that already have an established, solid track record with proven profitability. They invest in companies that they believe have the potential required to increase their earnings through operational improvements, cost-cutting measures, and other strategic initiatives. Private equity firms typically hold on to their investments for a longer period than Venture capital firms (usually between five to seven years), before selling them for profit.

Venture capital firms, on the other hand, invest in early-stage companies that are still in the process of developing their business models and establishing themselves in the market. These companies are often high-risk and high-reward, with the potential to grow rapidly if they succeed. Venture capital firms invest smaller amounts of capital, typically less than $10 million, but they do so across a larger number of companies, with the goal of spreading the risk across a diverse portfolio. Venture capital firms are looking for startups with innovative ideas and disruptive technologies that could transform entire industries.

After establishing product-market fit, acquiring early adopters, and building a great team of experts, there comes a time in the life of every promising startup when external funding is needed to scale. Although Venture Capital is probably your best bet, a competent CEO should have a good grasp of how both VC and Private Equity models work. CEO, ASPER BROTHERS Let's Talk

Another key difference between Private equity and Venture capital investors lies in the type of financing structures they use. To acquire companies, Private equity firms typically use debt financing, such as leveraged buyouts. They may also use mezzanine financing or preferred equity to invest in the companies they acquire. Venture capital firms, on the other hand, typically use equity financing, which involves buying a stake in a company in exchange for their share of future profits.

Private equity and Venture capital also differ in terms of their exit strategies. Private equity firms typically exit their investments through a sale to another company or a public offering. They may also sell their stake back to the company’s management team or other investors. Venture capital firms usually exit their investments through a sale to a strategic buyer or an IPO. They may also sell their stake back to the company’s management team or other investors, but this is a less common practice than in Private equity.

Overall, Private equity and Venture capital represent two very different investment strategies with distinct goals, risk profiles, and financing structures. Both types of investment are important sources of capital for companies at varying stages of their growth and development. While Private equity firms focus on established companies and long-term profitability, Venture capital firms are built around early-stage startups developing technologies that have the potential to transform entire industries. Understanding the differences between these two types of investments can help entrepreneurs and investors make informed decisions about how to raise the capital required to grow their businesses.

A comparison of venture capital and private equity timelines.

Venture capital firms are particularly well-suited to funding technology startups for several reasons:

This combination of capital, expertise, and connections makes Venture capital an ideal funding model for technology startups looking to grow and scale their operations quickly.

Private equity and Venture capital are two distinct funding models that serve different purposes. Private equity firms invest in mature and established companies that are not publicly traded or listed. They typically operate with large sums of money and in return they acquire full ownership and control of the companies they invest in. Private equity firms focus on streamlining operations to increase revenues and profits.

Venture capital firms, on the other had, invest in young businesses and startups with long-term growth potential. They focus on tech, clean energy, or biotechnology startups that are considered visionary.

Venture capital firms invest smaller sums of money in return for a smaller equity stake in the companies they invest in. They often bring valuable expertise and connections on board to help startups grow and succeed.

Private equity firms acquire full ownership and control of the companies they invest in, while Venture capital firms only take a minority equity stake. Additionally, Private equity firms tend to invest larger sums of money than Venture capital firms.

All in all, Private equity and Venture capital are both important sources of funding for businesses. However, they serve different purposes and tend to focus on different kinds of companies. Ultimately, all businesses must carefully evaluate their funding needs and goals to determine which type of funding constitutes their perfect fit. Maybe bootstrapping is the option for you?

The American start-up industry is going strong because of angel investor funding. Worried about the fact that your knowledge is...

Startup funding rounds refer to the different stages of funding that a tech startup goes through as it grows and develops...

We’ll explore everything startup founders need to know about due diligence, so you can head into your next funding round...

Great blog, keep it up.