28 Hottest Startups in Austin, TX

We've curated a list of Austin's hottest startups for 2023. These trailblazing companies are not only redefining innovation but...

In the world of startups, meticulous financial modeling is the foundation of all success.

A well-organized financial model helps guide your startup toward steady growth and profitability. It’s also the best early proof of your future profitability.

Understanding your startup’s financial situation is also critical to protecting against unexpected challenges. Financial modeling offers several benefits – it outlines future growth, tracks financial trends, evaluates budget needs, manages cash flow, and supports smart decision-making.

As you read on, you’ll learn more about startup financial models, why they are essential, what they include, and the right approaches to follow when preparing one. You’ll also find templates that can help you streamline this process.

With financial modeling, you’re not just predicting numbers, but shaping your startup’s trajectory.

In this article:

Understanding the financial trajectory of your startup is crucial for its survival and growth.

A startup financial model is a representation of your startup’s financial performance both in the past and the projected future.

Including a financial model in your startup’s business plan is non-negotiable. It not only helps in painting a realistic picture of your financial health but is also a critical asset when communicating with potential investors.

Here’s a closer look at what it entails and why it’s indispensable:

Financial modeling is a vital tool for startups even in the early stages, as it helps make educated predictions about their future.

A robust financial model helps lay out key milestones, track financial progress, support decision-making processes, and plays a significant role in securing financial backing from investors. It’s particularly essential for startups looking to raise capital and attract pre-seed funding, as it clearly articulates their projected growth, profitability, and expenses.

Moreover, a good financial model provides a comprehensive view of the past, present, and potential future performance of the business, proving to be an invaluable resource for entrepreneurs aiming to make informed decisions.

At its core, a financial model is a numerical expression of your startup’s goals.

It encompasses projections regarding the number of customers you’ll acquire, the number of employees you’ll hire, and how your margins will improve over time. It includes activities such as creating a hiring plan, making projections about sales, expenses, cash flow, income statement, and balance sheet, analyzing these projections, and producing profit and loss statements.

Even at the initial stages, having a basic income statement to manage revenue, operating expenses, and net income is imperative.

A more advanced and common type of financial model is the three-statement model, which integrates the three core financial statements: the income statement, the balance sheet, and the cash flow statement into one dynamic model to forecast future results.

This model is fundamental and often constructed in Excel spreadsheets, though many modern startups are transitioning to more streamlined software for this purpose. We’ve included some useful templates below.

Among the myriad tasks that demand a founder’s attention, crafting a sound financial model is paramount.

Whether you are seeking investment, planning to grow, or striving for operational excellence, a robust financial model is your ally. Here’s why:

Your startup’s financial model is a communication tool. It articulates your startup’s financial health and potential to investors, shareholders, and other stakeholders.

Including a robust financial model in your business plan helps present a clear picture of your startup’s value proposition, which is essential during fundraising and investor negotiations.

A financial model is your startup’s roadmap to economic viability. It helps in setting tangible financial targets and measuring your startup’s performance against these benchmarks.

Engaging in financial modeling allows you to ensure that your business model is economically sound and has the potential to be profitable in the long run.

The future is uncertain, more so in the dynamic landscape of startups.

A well-thought-out financial model prepares you for the unforeseen, enabling proactive management rather than reactive scrambling. It lays down various scenarios and equips you to navigate through financial uncertainties that may come your way.

Many startups tend to overlook the importance of a robust financial model and often get caught up in overly optimistic projections. It’s important to ground your model in real market data and reasonable assumptions and to steer clear of wishful thinking. This not only strengthens your business plan, but also resonates with potential investors, demonstrating a level of preparedness and pragmatism that is essential for success. COO, ASPER BROTHERS Let's Talk

In the absence of a financial model, you might venture into financially draining projects without a clear insight into the implications.

Financial modeling helps avoid such costly errors by providing a clear picture of the financial requirements and the potential return on investments, ensuring that resources are allocated wisely.

Informed decision-making is at the heart of a successful startup. A financial model provides a solid foundation for making key business decisions.

By having a clear understanding of your financial position, revenue streams, expenses, and cash flow, you can make well-informed decisions that steer your startup toward growth and sustainability.

Creating a financial model aids in visualizing your startup’s financial health and prepares you for the journey ahead.

Here’s a breakdown of the essential elements that your startup financial model should include:

Revenue projections form the backbone of your financial model, illustrating the money your startup is expected to make from sales and other income sources.

This section should be as detailed as possible, factoring in customer count, pricing strategies, sales channels, and any other relevant revenue streams.

An accurate estimate of your startup’s expenses is vital.

This section should encompass all costs associated with running your business – from operational to marketing expenses. It should also factor in any potential changes in the market that might affect your cost structure.

Cash flow is the lifeblood of your startup. Your financial model should include a detailed cash flow analysis, reflecting how cash moves in and out of your business.

This analysis will help you ensure that your startup remains solvent and has enough cash to cover essential expenses.

Understanding your startup’s capital structure and the capital required to achieve your business goals is crucial.

This section should outline your startup’s funding needs, depicting how much capital is required, the sources of this capital, and how it will be utilized.

Identifying and monitoring the KPIs relevant to your startup is essential for tracking its performance over time.

These indicators should align with your startup’s strategic goals and provide a clear picture of its financial health.

Scenario planning is about preparing for the unknown.

It involves creating different financial scenarios for your startup, helping you understand how various situations could impact your financial performance.

Accounting for growth factors such as hiring new talent, increasing revenue, and marketing spending is crucial for projecting your startup’s financial trajectory over time.

These factors should be meticulously detailed, providing a clear roadmap for achieving your startup’s long-term goals.

When crafting a financial model for your startup, there is a set of established best practices you should follow to ensure accuracy, clarity, and a comprehensive understanding of your financial situation.

They serve as guidelines that can significantly enhance the effectiveness and efficiency of your financial model, significantly contributing towards making your financial model a reliable tool for decision-making, planning, and communicating with stakeholders.

A deep understanding of your business model and industry is crucial as it helps in identifying the Key Performance Indicators (KPIs) that are most relevant to your startup.

These KPIs should reflect the factors that drive growth and profitability in your industry.

Aligning your KPIs with your strategic goals ensures that you are tracking metrics that directly reflect your startup’s overall strategic objectives and growth plan. For instance, if your primary goal is to rapidly expand your customer base, you might prioritize KPIs such as the number of new customers, customer acquisition cost, and customer lifetime value.

Ensure that your chosen KPIs are easy for stakeholders to find and understand within your financial model. Consider creating a dedicated KPI dashboard that presents these metrics in a visually appealing and easy-to-read format.

Including a capitalization table (cap table) in your financial model provides a clear picture of your startup’s ownership, equity dilution, and value of equity at different stages. It’s an essential tool for managing your startup’s equity and can be extremely helpful when negotiating with investors or selling your startup.

Creating a sense of urgency in your financial model can help motivate stakeholders and give them a clear understanding of the timelines involved. This could be achieved by highlighting the critical milestones and the financial implications of not achieving them within the stipulated timelines.

Formatting is crucial for the clarity and impact of your financial model. A well-organized, visually appealing model can help convey your message better and enable stakeholders to quickly grasp the essential information.

Regular testing and updating of your financial model are vital to ensure that it remains relevant and accurate. This includes revisiting your assumptions and adjusting them based on the latest available data.

Being prepared to answer questions and defend the assumptions in your financial model is crucial. This involves understanding the rationale behind every assumption and being able to explain them in a clear and concise manner.

Creating a financial model for your startup can initially seem daunting.

However, numerous templates are available online to guide you through this process. They provide a structured framework for organizing your financial data and projections in a clear, professional manner.

Whether you are looking for a simple template to get started or a more comprehensive template to delve into the nitty-gritty of startup financial planning, here are some platforms and resources where you can find startup financial model templates:

Smartsheet’s startup budget template includes a section for projected monthly costs.

Smartsheet offers free startup financial templates, which include aspects like startup business planning templates and competitive analysis templates. These templates assist in managing all aspects of your startup in real time, providing a structured approach to planning, budgeting, and analyzing costs.

Smartsheet’s set of dedicated templates for startups provides a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements.

On the same platform, there’s a set of pro forma templates designed specifically for startups. This set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement, aiding in detailing the current and projected financial position of your business.

Ramp’s free three-statement model template for startups is customizable and includes descriptions and comments that simplify navigation.

Ramp provides a free startup financial model template. It emphasizes goal setting and tracking as the backbone of every successful business, offering a template that dives into the what, why, and how of financial modeling for startups.

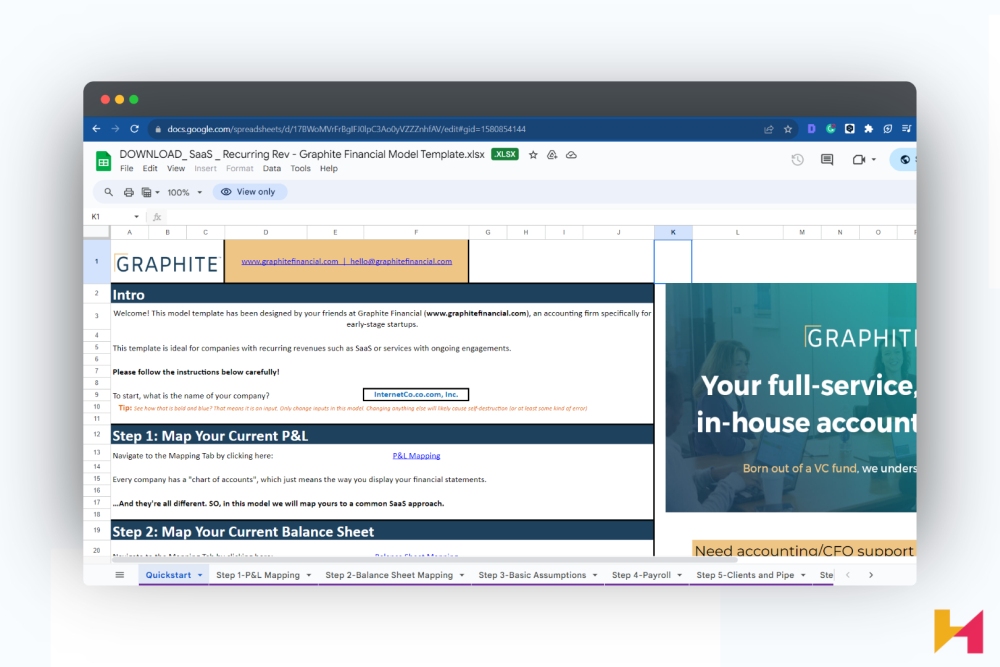

Graphite’s startup financial model template for SaaS is three-statement, meaning it has an Income Statement, a Balance Sheet, and a Statement of Cash Flow.

Graphite offers two free startup financial model templates for e-commerce platforms and SaaS. As a platform run by investors and startup advisors, it also brings in insights from having built and reviewed thousands of startup financial models, encapsulating best practices in its templates.

Slidebean’s financial model template includes a cap table and visual output dashboards.

Slidebean provides a free startup financial model template available for download in Excel and Google Sheets. This template helps estimate your revenue, expenses, and how much money your startup needs to raise, providing a structured framework to organize and analyze your financial data.

In the rapidly evolving startup landscape, the role of financial modeling will become increasingly important. As startups navigate the challenging path to sustainability and growth, robust financial models will continue to serve as their financial blueprint, helping them navigate the uncertainties of the business world.

Advances in financial technology and analytical tools will continue to refine the financial modeling process, providing greater accuracy and insightful foresight. This forward momentum signals a promising future where startups equipped with adept financial models can better strategize, adapt, and thrive in their entrepreneurial endeavors.

By embracing the evolving dynamics of financial modeling, startups are not only preparing to meet the financial challenges of today but also stepping into the future with a clearer financial perspective and poised readiness.

We've curated a list of Austin's hottest startups for 2023. These trailblazing companies are not only redefining innovation but...

An MVP contains only the features absolutely essential to convey value. An effective one can have a transformative impact on establishing...

Product-Market Fit is a key indicator of success that guarantees high levels of customer satisfaction and revenue growth. If you...